¿Es Louisiana un Estado sin culpa para los accidentes de coche?

Noticias y artículos

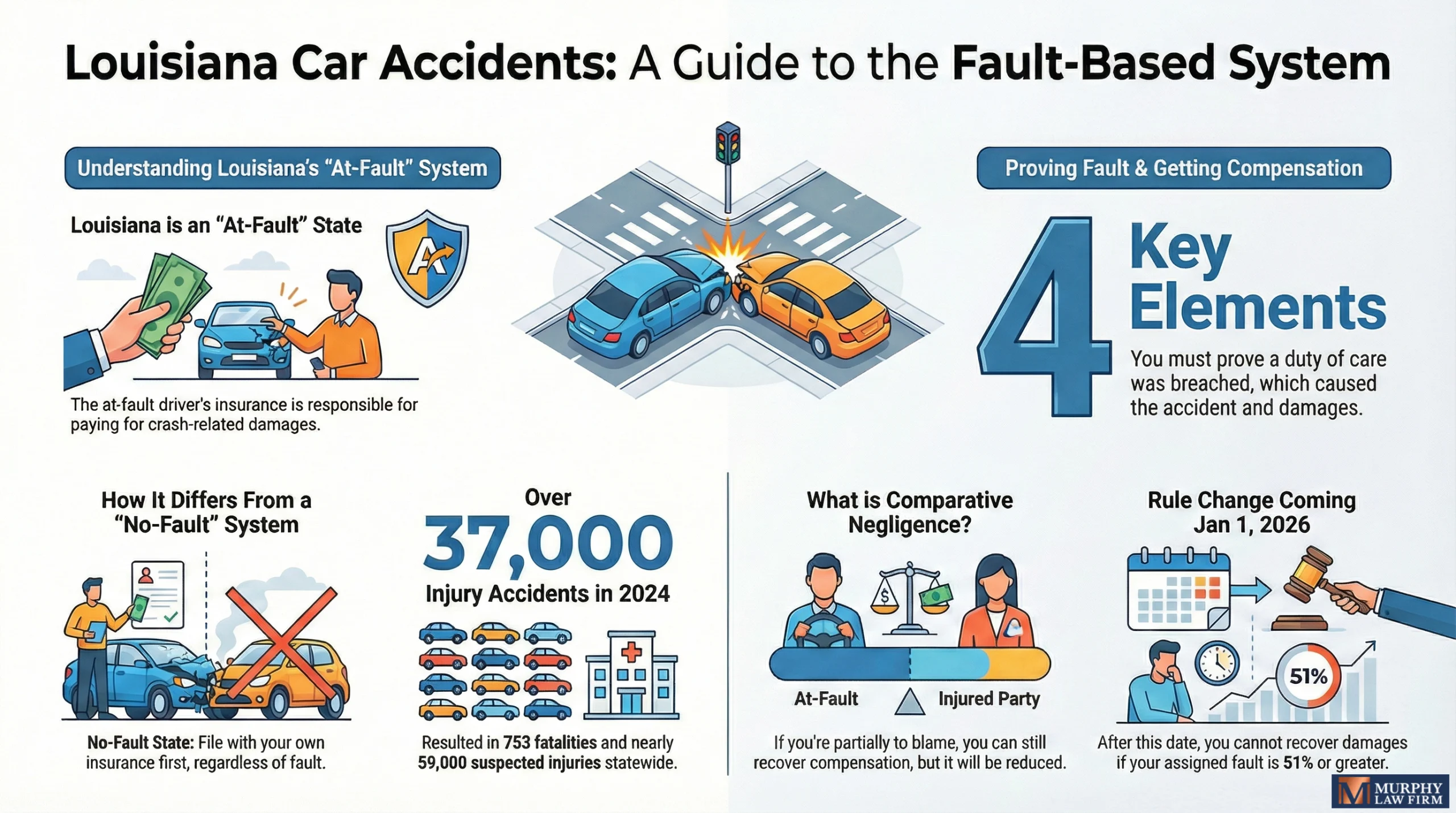

Esta publicación aclara que Louisiana es un estado basado en fallas. por accidentes de tráfico, lo que significa que las reclamaciones se presentan ante la aseguradora del conductor responsable del accidente. En 2024, el estado registró más de 108 000 accidentes con daños materiales y 753 víctimas mortales, con Este Baton Rouge y Nueva Orleans identificados como los principales puntos críticos de colisiones.

También detalla un importante cambio legal que entrará en vigor. 1 de enero de 2026: la transición a un sistema de culpa comparativa modificado. Según esta nueva norma, cualquier persona que sea encontrada 51% o más en falta queda estrictamente prohibido recuperar cualquier indemnización. Para aquellos con 50% o menos de culpa, los daños siguen siendo recuperables, pero se reducirán en función de su porcentaje específico de culpa.

Comprender las normas de culpa de un estado es muy importante cuando te ves implicado en un accidente y necesitas recuperar los costes de los daños materiales, las lesiones y otras pérdidas. Algunos estados no tienen culpa en el seguro de coche, mientras que otros se basan en la culpa. Así que.., ¿es Louisiana un estado sin culpa en accidentes de tráfico?

Louisiana no es un estado sin culpa. En su lugar, los accidentes de vehículos operan en un sistema basado en la culpa cuando varios vehículos están involucrados en un accidente. Cuando otro conductor es el culpable de la colisión de tu vehículo, puedes presentar una reclamación de seguro a su compañía de seguros para recuperarte económicamente tras el accidente.

¿En qué se diferencia un sistema de culpabilidad de un sistema de no culpabilidad en accidentes de tráfico?

La diferencia entre un sistema de culpa y un sistema de no culpa es dónde se presenta la reclamación al seguro después de un accidente. La mayoría de los Estados se rigen por leyes de culpa, en las que el conductor u otra parte culpable del accidente es responsable de los daños resultantes. Las reclamaciones se presentan a la aseguradora de esta parte. Esto es diferente de un sistema sin culpa, en el que todas las partes implicadas reclaman con su propia cobertura de seguro para recuperar las pérdidas financieras y personales, independientemente de quién causó el accidente.

Accidentes de vehículos en Louisiana

En 2024 en Louisiana, había aproximadamente 108.090 accidentes sólo con daños materiales y 37.387 presuntos accidentes con heridos. Estos accidentes con heridos provocaron 58.981 presuntos heridos. Lamentablemente, también se produjeron 706 accidentes de tráfico mortales, con 753 víctimas mortales en el estado.

En mayor número de accidentes de tráfico se produjeron en la parroquia de East Baton Rouge, seguida de Nueva Orleans y la parroquia de Orleans. East Baton Rouge Parish también tuvo el mayor número de accidentes mortales, presuntos heridos leves, posibles heridos y sólo daños materiales, pero Nueva Orleans tuvo el mayor número de presuntos accidentes con heridos graves.

Cómo afectan las leyes de culpabilidad a las víctimas de accidentes de tráfico

En Louisiana todo el mundo está obligado a tener un seguro de coche que cubra un mínimo de lesiones y daños materiales a terceros en caso de accidente. Debido a esto, usted tiene que demostrar quién tuvo la culpa del accidente después de estar involucrado en uno.

Las compañías de seguros de todos los conductores implicados en el accidente llevarán a cabo sus propias investigaciones sobre la colisión para determinar la culpa. Estas compañías de seguros no velan por sus intereses, sino por sus propios resultados. Para proteger sus propios intereses, necesita contrate a un abogado experto en accidentes de tráfico. Pueden ayudar a investigar el accidente, reunir pruebas y demostrar quién es el responsable.

Para demostrar que otra parte es responsable de sus lesiones en un accidente, tiene que probar:

- Le debían un deber de cuidado. Todos los conductores que circulan se deben mutuamente el deber implícito de comportarse razonablemente, respetar las leyes de tráfico y tener un cuidado razonable para evitar causar lesiones.

- Incumplieron el deber de diligencia. Generalmente se debe a una acción u omisión negligente.

- Su imprudencia causó el accidente. Si el accidente fue causado en su totalidad por algo distinto a la acción negligente, esa parte no es responsable.

- El accidente causó daños. Debe presentar pruebas de sus daños reconocibles, como sus lesiones.

Los conductores son a menudo responsables de comportamientos negligentes como el exceso de velocidad, ignorar el derecho de paso, conducir distraído, estar bajo los efectos del alcohol o conducir agresivamente.

Negligencia comparativa en Louisiana

Los sistemas basados en la culpa se complican aún más por la existencia de leyes de negligencia comparativa. Cuando varias personas tienen parte de culpa en un accidente, cada una puede ser considerada responsable de su porcentaje de culpa.

Si has sufrido lesiones en un accidente de coche y has tenido parte de la culpa, aún puedes recibir una compensación económica siempre que tu porcentaje de culpa sea inferior a 51%. Esto te permite cubrir parte de tus pérdidas, pero limita la indemnización que recibes. Por ejemplo, si el tribunal determina que tuviste 20% de culpa en el accidente, sólo recibirás 80% del total de los daños calculados.

La negligencia comparativa también le permite reclamar daños y perjuicios a varias compañías de seguros si la culpa es de otros muchos conductores.

A partir del 1 de enero de 2026, Louisiana aplicará un estándar de culpa comparativa modificado a los accidentes automovilísticos que cumplan los requisitos. Una persona lesionada solo podrá obtener una indemnización por daños y perjuicios si la culpa que se le atribuye es 50% o menos; un hallazgo de 51% o superior impide la recuperación. Si se permite la recuperación, la indemnización por daños y perjuicios se reduce en proporción al porcentaje de culpa de la persona. Este cambio se aplica a los accidentes que ocurran a partir del 1 de enero de 2026.

Preguntas frecuentes

¿Cómo se determina la culpa en un accidente de tráfico en Louisiana?

La culpa en un accidente de coche en Louisiana se determina a través de una investigación exhaustiva, utilizando pruebas como grabaciones de CCTVlos registros del móvil y el informe del accidente. Estas pruebas deben demostrar lo siguiente para demostrar la culpa:

- El conductor le debía un deber de cuidado.

- El conductor incumplió ese deber de diligencia, normalmente debido a un comportamiento negligente.

- Su infracción causó el accidente o fue un factor importante para causarlo.

- El accidente le causó lesiones y otros daños.

¿Quién paga los daños del vehículo en un Estado culpable?

El conductor culpable paga los daños del vehículo en un estado de culpa, así como otros daños causados por el accidente, como el coste de tus lesiones. Si sus lesiones o daños al vehículo superan los límites de cobertura del seguro de la parte culpable, es posible que tenga que recuperar los daños adicionales a través de su propia póliza de cobertura. Un abogado puede ayudarle a revisar su situación particular y sus opciones de indemnización.

¿Tiene Louisiana seguro de coche sin culpa?

No, Louisiana no tiene un sistema de seguro de coche sin culpa. En su lugar, las reclamaciones se presentan ante la compañía de seguros del conductor culpable del accidente. Estas reclamaciones pueden recuperar cualquiera de los daños económicos y no económicos que hayas sufrido en el accidente. Si usted y el asegurador culpable no pueden llegar a un acuerdo justo, entonces usted puede ser capaz de llevar el caso a los tribunales para recuperar sus daños. Un abogado puede ayudarle en estos casos.

¿Quién tiene la culpa en una colisión por alcance en Louisiana?

Cada colisión trasera en Louisiana es diferente, por lo que no hay forma de saber con certeza quién tiene la culpa del accidente. A menudo, el conductor que chocó por detrás al otro conductor es la parte culpable, pero esto no siempre es cierto. El conductor de delante puede haber actuado con negligencia al frenar en seco o no prestar atención a los cambios en la carretera. El conductor de atrás puede haber actuado negligentemente porque conducía distraído.

Recuperación de la indemnización en un sistema basado en fallos

Cuando se lesiona en un accidente de coche, puede presentar una reclamación al seguro. Si la compañía de seguros no le da un acuerdo justo, puede llevar el caso a los tribunales y presentar una demanda por lesiones personales. Recuperar la compensación que se le debe es mucho más fácil con un abogado, ya sea negociando un acuerdo o abogando por un veredicto.

En Murphy Law Firm, podemos ayudarle en cada paso del camino, desde la investigación de la culpa hasta la evaluación del valor de sus pérdidas. Contacte con nuestro bufete hoy.